Revenue Meaning, Formula, Examples, Sources and Types

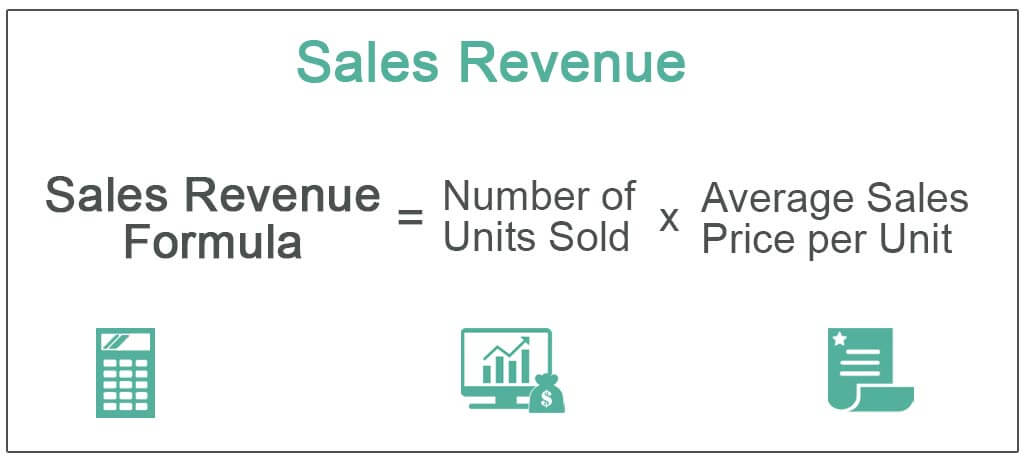

Regression models that account for many internal and external factors are among the more sophisticated techniques. There is much more that can be included in a forecast than just the number of units x average price, as you can see in the example above. Depending on the sector they operate in and the pursuits they make, businesses generate various forms of revenue.

Total revenue vs. net revenue

- This $213 is the sum that typically appears on the income statement’s top line.

- Therefore, the net revenue formula should be calculated for each product or service, then added together to get a company’s total revenue.

- If you use accrual accounting, total revenue is revenue that is recognized but not yet received, and it’s called accrued revenue.

- For example, if that trendy trainer cost you £25 to create your net revenue would be £75.

- These two terms are used to report different accumulations of numbers.

It is a valuable figure to stakeholders because it indicates the health and potential growth of a company. From the example we had above, operating revenue is the income derived from the sales of lipsticks and school supplies. The total revenue of the supply shop is $6,600, after adding the revenue on each of the products sold. For example, when a company releases its financials for each quarter, the financial media reports whether revenue and earnings per share (EPS) are above or below expectations.

What Revenue Reporting Is Used for

The Countingup business account comes with free accounting software that helps thousands of small businesses keep on top of their financial management. Designed specifically for one-person businesses, this unique two-in-one app makes running your business much easier. This is because it appears first on a business’s income statement.

Net Revenue Vs Gross Revenue

Accurately calculating revenue can give you insights into new opportunities for your business. This is when you subtract the cost of goods sold from your gross revenue. There might be extra production fees, shipping costs or storage costs. Plus, you might even offer discounts, allowances or returns that can contribute to net revenue. For example, if that trendy trainer cost you £25 to create your net revenue would be £75. Price elasticity refers to how the price of a product or service interacts with the demand for that product or service.

What is financial reporting? 8 must-measure metrics for small businesses

There can be some misconceptions about net and gross revenue, which might affect your income tax if not done correctly. Revenue is the total money that a business earns from its normal business activities. The revenue recognition principle refers to the accounting principle that requires revenue to be recognized when it is earned, not necessarily when cash is received. Non-operating revenue is generated from outside the main operations of a business.

Accrued and deferred revenue

Regardless of the technique, businesses frequently report net revenue instead of gross sales (which removes things like discounts and refunds). Accounting software can make it easier to calculate your revenue and understand how your business how to find revenue in accounting is doing. Apps like Countingup do more than put all of your finances in one place to increase transparency. They also offer tools to help you understand your money better and save you time so you can focus on your daily operations.

Fortunately, many different accounting software packages can make the process easier. And while it might not be the most exciting topic, understanding the basics of accounting can give you a real competitive advantage in business. ” However, offering discounts results in major benefits, like increased sales and customer loyalty. We’ll also share examples that’ll transform you into a sales metrics superstar. The terms cost and gross sale are closely related since business entities determine their profit by deducting the cost of goods sold from revenue. Regardless of the method used, companies often report net revenue (which excludes things like discounts and refunds) instead of gross revenue.

It is a quantification of the gross activity generated by a business, which is the average unit price charged to customers, multiplied by the number of units sold. Revenue is generally created when either goods or services are sold. However, it may also include other activities, such as the sale of memberships or subscriptions. The sum of the company’s revenues from the sale of its products and services is known as revenue. Therefore, the most crucial criterion in determining how well a business is doing is its income.