How Companies Calculate Revenue

For example, suppose a Shop sells bouquets — and each cake costs the Shop $7 in materials to make. They sell the bouquets for $16, meaning the profit for each bouquet is $9. For example, if you’re a hairdresser, you may offer haircuts, blow outs, and hair dying. Each service will cost different amounts, so create a list with corresponding prices. You can then look at your invoices to determine how much of each service you sold.

Top 5 Mobile Accounting Apps for Small Business: Streamline Your Finances

Simply multiply the sum of the sales of each product to enter the calculation. As a result, the business will create a “accounts receivable” account on the balance sheet and include the revenue on the income statement. Regardless of whether the goods or service has been delivered, recognized revenue is a record of all sales. Although total revenue is defined differently in economics, it has the same meaning as it does in accounting. It is described as the money a company makes from the sale of its goods.

- Basically, revenue is the total amount of money that your business gets from selling your products or services to customers.

- There are a lot of different ways to generate income for a business.

- Income is often used to incorporate expenses and report the net proceeds a company has earned.

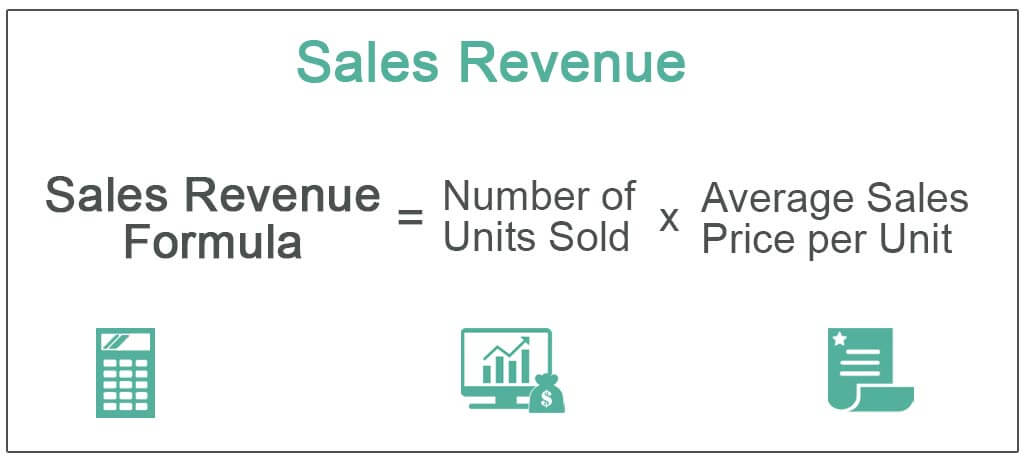

- It is a quantification of the gross activity generated by a business, which is the average unit price charged to customers, multiplied by the number of units sold.

- For example, a company can have $10 million in sales but $12 million in revenue if nonoperating income totals $2 million.

What is the difference between gross and net profit

Selling your product or service and the revenue you earn from those sales is operating revenue. When you analyze your revenue position, you use only operating revenue in the equations because non-operating revenue is irregular in nature. From the example above, you, as a business owner, know that if you have to drop the price of your product, you have to increase your sales by a specific amount. You can find out how much more you have to increase your sales to increase your gross profit by using the same equation.

Audited Financial Statements for Small Business A Must Have?

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. You sell a car for $20,000, a pack of 6 oil changes for $200 and a pair of floor mats for $75. A revenue forecast can also help you anticipate seasonal demand changes and make necessary adjustments to your plans.

It should be noted that gross revenue is another name for total revenue. Money received in advance for goods or services that will be provided in the future is known as deferred revenue. Deferred revenue is referred to as “unearned” revenue in accrual accounting and is shown as a liability on the balance sheet. Cash accounting records undelivered products or services that have been paid for as a receipt rather than as revenue. When evaluating the health of a company using gross revenue, especially subscription-based businesses, there are various dangers to watch out for.

Keeping an eye on your business’s finances is oh-so-important if you want your company to thrive and grow. This includes monitoring your financial statements and calculating financial figures, such as total revenue. Get the lowdown on how to calculate total revenue and ways to use it to benefit your business. Revenue gets included on your income statement, and it’s usually on the first line.

Accrued revenue is the type of revenue that has been earned but not yet received. This means that the product or service has been provided but the customer how to find revenue in accounting has not yet paid for it. Companies get revenue in many different ways, but the easiest one to understand is the sales of products or services.

Your company’s primary line of business generates operating revenue. Operating revenue is the money you make from selling your goods or services and the money you get in return. Because non-operating revenue is irregular in nature, you only utilize operational revenue in the calculations when analyzing your revenue position. Revenue that a company receives for goods or services that have been provided but have not yet been paid for by the customer is known as accrued revenue. It’s important to emphasize once more the distinction between total income and sales revenue. This covers any income derived from transactions, investments, or marketing activities.

In fact, 70% of users who are browsing search results click on well-known businesses. Lots of website traffic might be produced by an effective SEO approach. An increase in internet traffic does not necessarily translate into more revenues for all firms, though.

This is opposed to net income, which is known as the bottom line. Instead of doing manual calculations, the software computes the totals and lists them on reports. One of the biggest things that you can do with all your revenue data is update and maximize your pricing strategy. Looking at and analyzing your revenue can help you recognize if you’re charging too much or too little for your product or service.